California Real Estate Withholding Tax . The purpose of form 593 is to ensure compliance with the california revenue and taxation code. It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. Buyers must withhold 3 1/3 percent of the gross. real estate withholding is a prepayment of income tax due from the selling of california land or anything on it (real property). real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. what is the california law for withholding on the sale of california real property? california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use.

from printableformsfree.com

real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. Buyers must withhold 3 1/3 percent of the gross. The purpose of form 593 is to ensure compliance with the california revenue and taxation code. form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use. what is the california law for withholding on the sale of california real property? real estate withholding is a prepayment of income tax due from the selling of california land or anything on it (real property).

Fillable California Real Estate Tds Form Printable Forms Free Online

California Real Estate Withholding Tax It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. what is the california law for withholding on the sale of california real property? real estate withholding is a prepayment of income tax due from the selling of california land or anything on it (real property). california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use. form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. The purpose of form 593 is to ensure compliance with the california revenue and taxation code. It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. Buyers must withhold 3 1/3 percent of the gross.

From www.uslegalforms.com

Certificate Of Publication Maryland With Withholding Real Estate US California Real Estate Withholding Tax The purpose of form 593 is to ensure compliance with the california revenue and taxation code. what is the california law for withholding on the sale of california real property? real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. It serves as a mechanism for the. California Real Estate Withholding Tax.

From blog.softprocorp.com

January State Regulatory Updates California Real Estate Withholding Tax form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. what is the california law for withholding on the sale of california real property? It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. Buyers must. California Real Estate Withholding Tax.

From www.pdffiller.com

Fillable Online ftb ca 2006 Real Estate Withholding Remittance California Real Estate Withholding Tax The purpose of form 593 is to ensure compliance with the california revenue and taxation code. It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale. California Real Estate Withholding Tax.

From stephenhaw.com

Rates of Property Taxes in California's The Stephen Haw Group California Real Estate Withholding Tax real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. what is the california law for withholding on the sale of california real property? It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property.. California Real Estate Withholding Tax.

From www.pinterest.com

California Real Estate Licensing Law. Tap To Watch Video in 2021 Real California Real Estate Withholding Tax It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. what is the california law for withholding on the sale of california real property? The purpose of form 593 is to ensure compliance with the california revenue and taxation code. form 593, also known as. California Real Estate Withholding Tax.

From www.peetlaw.com

Vermont NonResident Withholding Tax California Real Estate Withholding Tax form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. what is the california law for withholding on the sale of california real property? It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. Buyers must. California Real Estate Withholding Tax.

From www.formsbank.com

45 California Ftb 593 Forms And Templates free to download in PDF California Real Estate Withholding Tax real estate withholding is a prepayment of income tax due from the selling of california land or anything on it (real property). california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use. Buyers must withhold 3 1/3 percent of the gross. form 593, also known as the. California Real Estate Withholding Tax.

From fromschannel.com

[원천과세 / Withholding Tax][미국부동산] 캘리포니아 주정부의 부동산 원천과세(California real California Real Estate Withholding Tax form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified. California Real Estate Withholding Tax.

From www.pinterest.com

California Real Estate Exam Questions and Answers 100 Pass in 2023 California Real Estate Withholding Tax california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use. real estate withholding is a prepayment of income tax due from the selling of california land or anything on it (real property). The purpose of form 593 is to ensure compliance with the california revenue and taxation code.. California Real Estate Withholding Tax.

From www.formsbank.com

Fillable California Form 593C Real Estate Withholding Certificate California Real Estate Withholding Tax real estate withholding is a prepayment of income tax due from the selling of california land or anything on it (real property). real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. Buyers must withhold 3 1/3 percent of the gross. what is the california law. California Real Estate Withholding Tax.

From www.formsbank.com

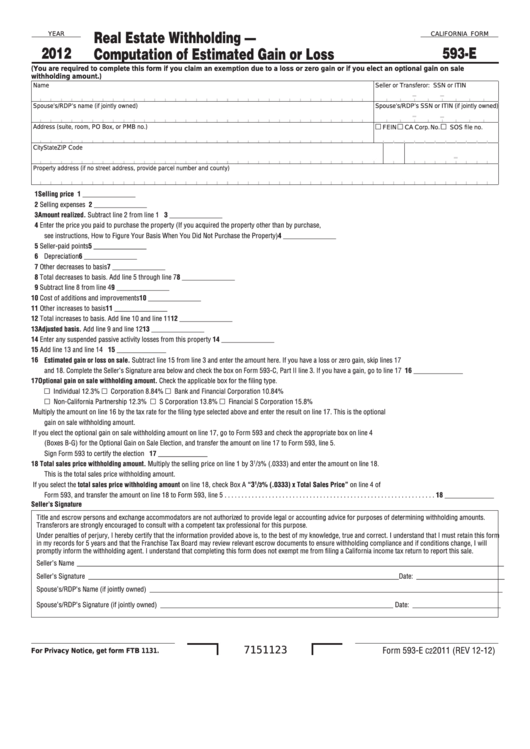

California Form 593 Real Estate Withholding Tax Statement 2012 California Real Estate Withholding Tax form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. what is the california law for withholding on the sale of california real property? The purpose of form 593 is to ensure compliance with the california revenue and taxation code. It serves as a mechanism for the collections of. California Real Estate Withholding Tax.

From drediqlarine.pages.dev

Ca 593 Form 2024 Katey Dolorita California Real Estate Withholding Tax california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use. The purpose of form 593 is to ensure compliance with the california revenue and taxation code. Buyers must withhold 3 1/3 percent of the gross. real estate withholding is a prepayment of income (or franchise) tax due from. California Real Estate Withholding Tax.

From chart.issuessul.com

[원천과세 / Withholding Tax][미국부동산] 캘리포니아 주정부의 부동산 원천과세(California real California Real Estate Withholding Tax It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. The purpose of form 593 is to ensure compliance with the california revenue and taxation code. form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. . California Real Estate Withholding Tax.

From www.youtube.com

California Real Estate Withholding Tax How Can You Avoid It? YouTube California Real Estate Withholding Tax form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. Buyers must withhold 3 1/3 percent of the gross. what is the california law for withholding on the sale of california real property? The purpose of form 593 is to ensure compliance with the california revenue and taxation code.. California Real Estate Withholding Tax.

From www.safesthomes.com

California Association of Realtors’ Housing Market Predictions Real California Real Estate Withholding Tax real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. real estate withholding is a prepayment of income tax due from the selling of california land or anything on it (real property). It serves as a mechanism for the collections of state income tax on the gain. California Real Estate Withholding Tax.

From www.amonteam.com

Colorado 2 Real Estate Withholding Tax California Real Estate Withholding Tax Buyers must withhold 3 1/3 percent of the gross. california real estate withholding if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use. It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property. real estate withholding is a prepayment. California Real Estate Withholding Tax.

From www.studocu.com

Real Estate Laws California Real Estate Laws California California California Real Estate Withholding Tax what is the california law for withholding on the sale of california real property? real estate withholding is a prepayment of income tax due from the selling of california land or anything on it (real property). form 593, also known as the “real estate withholding certificate,” is a document used in california real estate transactions. california. California Real Estate Withholding Tax.

From studylib.net

California Withholding Tax on the Sale of Real Property I California Real Estate Withholding Tax Buyers must withhold 3 1/3 percent of the gross. real estate withholding is a prepayment of income (or franchise) tax due from sellers on the gain from the sale of. The purpose of form 593 is to ensure compliance with the california revenue and taxation code. real estate withholding is a prepayment of income tax due from the. California Real Estate Withholding Tax.